- The Need for SMS Solutions for Customer Communication

- How SMS Works?

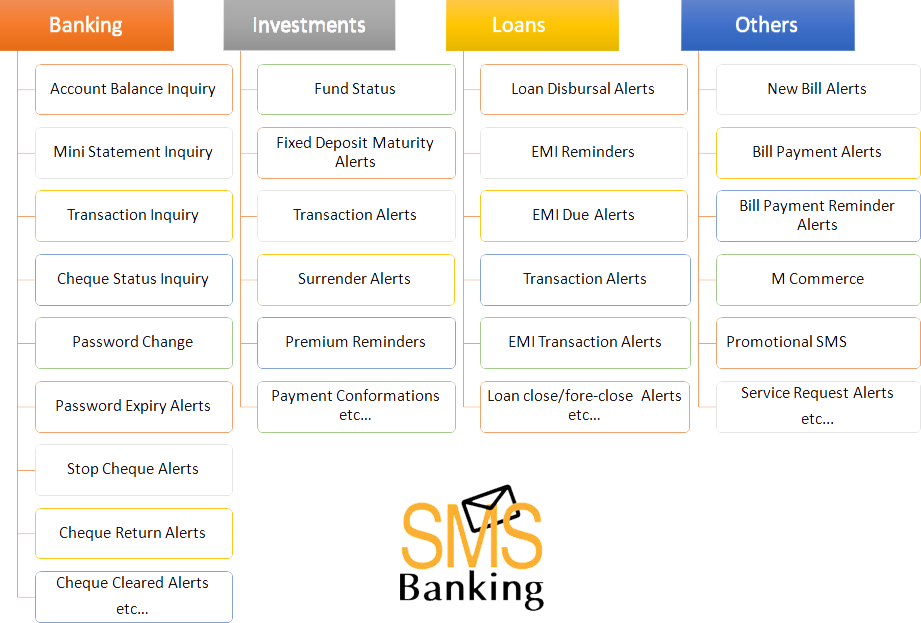

- What it features?

- Functionalities

- Enterprise Messaging Features

- Technical Solution

- Implementation Strategy

- Clientele Enterprise SMS Solution

The telecommunications industry worldwide has scrambled in bring available of networked computers to mobile devices.

Presently, the use of electronic banking is considerably high (i.e. banking outside the banking hall) and is on the increase.

With electronic banking, users can now conveniently carry out banking transactions

But this convenience cannot be achieved if the user does not have access to the internet.

Hence, in other words, the user cannot carry out a banking transaction while waiting for a bus, or lunch in a restaurant etc...

With SMS banking, convenience can be achieved 24hrs a day.

This is because a user has access to his mobile phone all day, at all times.

A truly mobile mode of banking has to be explored by SMS Banking

SMS banking is a service that allows customers to access their account information via mobile phone.

SMS banking services are operated using both push and pull messages.

Push messages are those that the bank chooses to send out to a customer's mobile, without the customer request .

Pull messages are those that are initiated by the customer, using a mobile, for obtaining information or performing a transaction.

Safety

- All transactions above a value desired are intimated to the customer

- As and when they happen, so customer can always kept updated on their transactions.

Convenience

- No need to queue in at bank or ATM to check your account.

Updates

- Bank can send updates on deposits/loan instalments due

- Interest rate changes and new products to the customer...

Availability

- This service is available from anywhere in the world

- Even when customers are on the move